Most Americans Aren’t Going for Long-Term Care Insurance, ‘But They Will, Where They Work,’ says James Dettman of ACSIA Partners

June 19, 2017

He joins a company with a plan to make LTC insurance as common as health insurance

KIRKLAND, Wash., June 19, 2017 (SEND2PRESS NEWSWIRE) — James Dettman, a

veteran of the insurance and employee benefits industries, has joined ACSIA

Partners, one of America’s largest long-term care insurance agencies. He will

serve as one of four Worksite Sales Directors.

So? He’s a man with a mission. Like David with a glint in his eye, he’s

aiming to help bring down an American Goliath, our looming long-term care

crisis.

“Nearly three in four Americans over 65 will need long-term care at some

point,” Dettman says, quoting the U.S. Department of Health and Human Services.

“So virtually all families will be affected. Somebody will probably need care.

If not Dad, Mom; if not you, your spouse.”

“This is a very big deal,” he asserts, because —

- Long-term care can eat into retirement savings, costing from tens of

thousands to $100,000, $200,000 or even more per year, depending on

location, type of services, and type of claim. - Family members may be forced into caregiving, disrupting their lives and

affecting their ability to earn a living and protect their livelihood. - Companies suffer, too. They report reduced productivity when employees

worry about loved ones needing care.

“Long-term care insurance is the answer,” Dettman asserts, “but most

consumers aren’t buying it. No problem. We just need to start offering it more

aggressively through another channel, the workplace.”

He points to key advantages over policies sold directly to consumers:

- Group rates are generally lower

- Health screening is relaxed

- Family members can be included

ACSIA Partners is a pioneer in worksite LTC with a successful team in place,

and that’s why Dettman joined them, he says. “I’m here to help them take it to

the next level.”

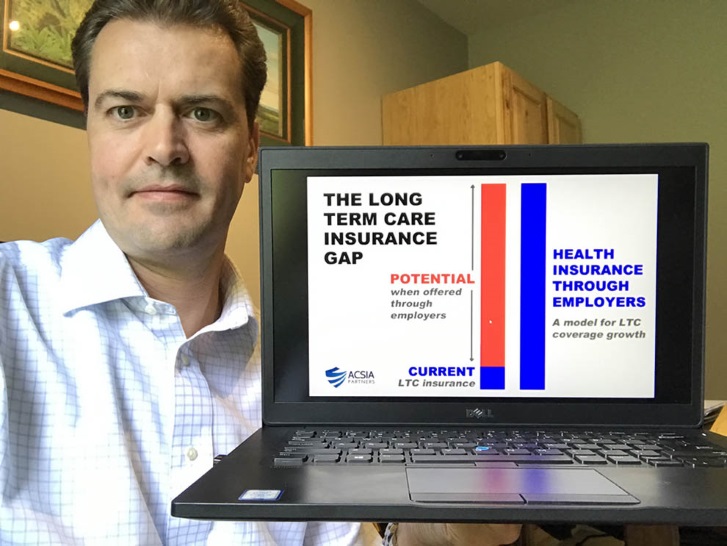

The potential is very large. According to the American Association for

Long-Term Care Insurance, only 10 million or so Americans have bought long-term

care insurance; and only a fraction have gotten it at their place of work.

By contrast, over 270 million have health insurance, and a majority, 155

million, have it through their employer, according to the Urban Institute.

“We need to go with what’s working,” says Dettman. “If we follow the lead of

health insurance, within a few years up to 155 million can have easy access to

LTC protection through their jobs,” he says. “We’ll have multiplied the business

15 times over, and more important, released a flood of economic and personal

vitality.”

To get the ball rolling, Dettman and colleagues are seeking alliances with

benefit brokers, insurance brokers, consultants, human resource managers,

executives and association directors. “Our focus is to help deliver financial

savings strategies for employees and employers alike,” he says.

For over 20 years, James Dettman has held sales, sales management, and sales

consultant positions in the insurance and employee benefits fields, winning many

promotions and setting sales records.

He has been a member of the National Association of Health Underwriters

(NAHU) since 1997, serving on the Board of Directors for his local association

and twice as President for two different Chapters. He is also a Lifetime

Qualifier for the Leading Producers Round Table (LPRT).

He will serve alongside fellow Worksite Sales Directors Dan Cahn, Ed Jette,

and Mario Sestito, “a crack team leading the charge toward universal LTC

protection,” according to Dettman.

ACSIA Partners LLC is one of America’s largest and most experienced long-term

care insurance agencies serving all states. The company is also a co-founder and

sponsor of the “3in4 Need More” campaign, which encourages Americans to form a

long-term care plan.

Dettman and colleagues may be reached at the following numbers:

- James Dettman: (901) 301-7421

- Dan Cahn: (425) 284-2148

- Ed Jette: (508) 981-6261

- Mario Sestito: (518) 817-3446