A Quick Look at Long Term Care Today

To understand how important it is to start planning for long term care, you need to know how relevant it is to your current situation and how likely you may need help. Below are some startling statistics about long term care in America.

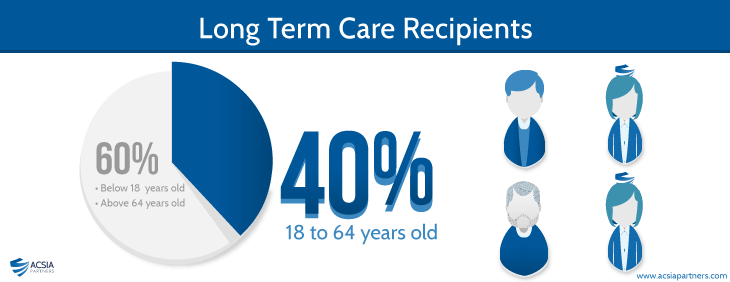

40% of people receiving long-term care are working-age adults between the ages of 18-64.1

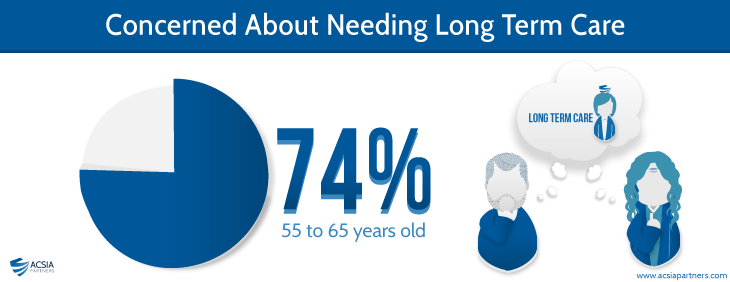

74% of consumers ages 55 to 65 polled for a recent survey said they are concerned about

needing some kind of long term care.2

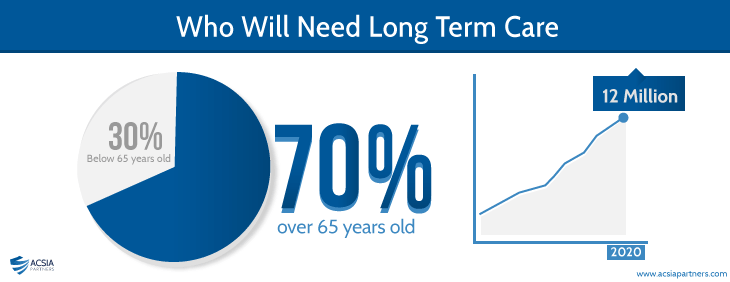

About 70% of Americans over the age of 65 will need long-term care services during their lifetime. By 2020, this number is expected to exceed 12 million.3

Aging baby boomers will significantly impact the potential demand for long-term care services over the next two decades. Over the next 20 years, the number of Americans age 65 and older will more than double to 71 million, comprising roughly 20% of the U.S. population.2

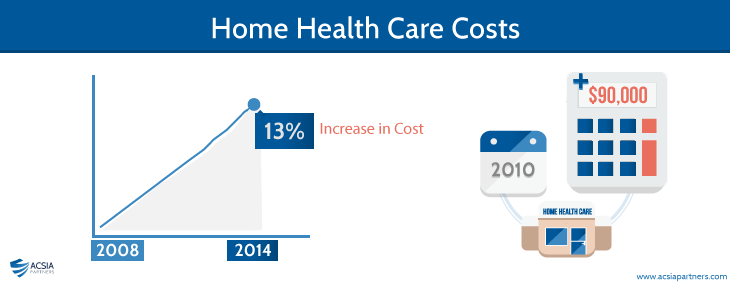

Nationally, home health care costs have grown by 13% since 2008 and the annual cost for a private room in a nursing home exceeds $90,000 in 2010.3

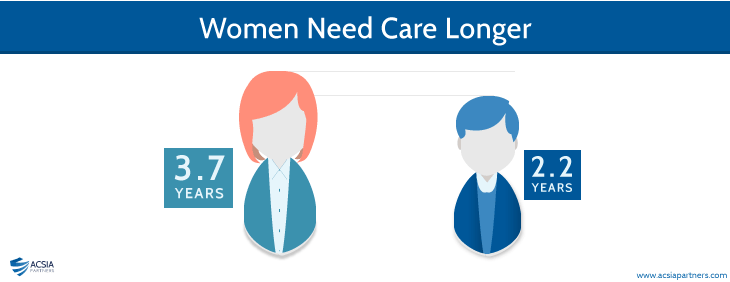

Women will need care longer (3.7 years on average) than men (2.2 years on average), mainly because women typically live longer.1

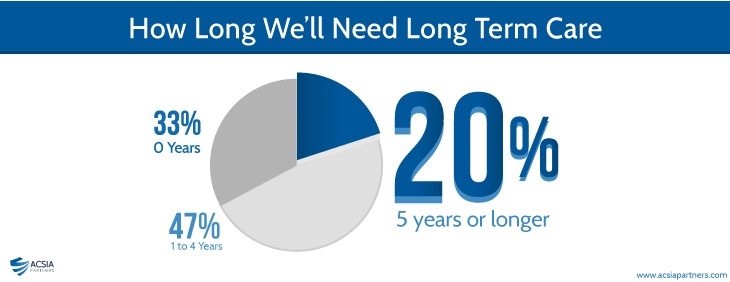

While about 1/3 of people 65 years old may not ever need long term care services, 20% will need long term care for longer than 5 years.1

Sources:

1 National Clearinghouse for Long Term Care Information, 2008

2 Prudential Financial Inc. Newark, N.J. 2010 Long Term Care Cost Study

3 Prudential Research Report: Long Term Care Cost Study, 2010

Are you ready for long term care?

Traditional health insurance and disability insurance are not designed to pay for long term care services. Additionally, Social Security and Medicare do not pay for the costs of long term care. Private long-term care insurance may be your best option to help cover the future cost of care. Start planning today.